I hit with my Southwest Card, but it was an offer I already activated. Misses on my CFU and CSP.

Preface this as I am a basic rewards user, usually just statement credits but…

Was looking for a decent card for gas rewards and came across this US Bank card… U.S. BANK ALTITUDE CONNECT and doesn’t seem like a terrible card at face value. Anyone have experience?

Wells Autograph card looks good too.

If not what is the go to for Gas rewards? I am thinking Citi Premier + as I already have custom cash for groceries and would like to stay in the Citi environment but would look at Chase options as well.

I think it depends on what you are looking for - straight cash back seems like it is a good card on the surface, but BofA doesn’t utilize transfer partners to transfer points to (limits the ceiling to any redemptions where a lot of value is located).

I like a combo for gas rewards - Chase Freedom always has a 5% at gas stations for one quarter of the year (limit to $1,500 spend per quarter) and then the Blue Cash Preffered by AmEx is 3% on US gas stations (6% on groceries up to $6k per year) and both Chase and AmEx have the most holistic transfer partners with the points. If you like Citi and want to stay in that Ecosystem, then the Premier is a good option to swap with the AmEx.

Costco Citi Visa card gets 4% on gas plus membership in their clubs. Couple that with Costco gas being the cheapest around it works great if you have a club remotely near by.

If there’s a specific gas station brand that you go to most often, might be worth checking out that brand’s cards and/or mobile payment apps. I get 15 cents off per gallon for using the Phillips 66 app at any P66, 76 or Conoco station and paying via my Amazon Prime visa which is stored in the app (and that gets another 2% off, so it works out to like 20 cents off per gallon).

I love my AMEX BCP for groceries, but my biggest gripe is that you don’t get the gas rewards at super market gas stations like Kroger fuel.

Heads up that new offers rolled out! 10x on gas and 5x at Amazon on my Marriott Boundless

I got an email last week from Chase for my United Card that I will get 10x on gas and 5x on Amazon and grocery.

I got the same with my Chase Southwest card.

That’s a good one to have it on. I didn’t get any hits on my sapphire right now, so will just take advantage of the Marriott for the time being

Amex Member Week next week

Don’t know where else to vent this so this seems like a good place. Disclaimer: This was my fault in the end for being a dumbass, but still very frustrating.

I had a stupid chase sapphire card that I never used. I had forgotten I put a Legal Zoom fee on auto pay on that card inexplicably. Anyways, back in July I get a call from chase that my card is overdue. I’m like what the hell I don’t even use it. Got it sorted that it was Legal Zoom charge for like $189 and paid it no problem then stopped the auto pay. Forgot all about that card and on top of it they have an old email for me.

Fast forward to Friday and I get a Credit Sesame alert that my credit dropped 55 points! What. The. Fuck. Start digging and it’s for missed payments on the Chase card. Turns out that after paying $189 there was a $2.35 interest fee that rolled to the next month. To their credit they did email me to the old email address but never got a phone call. So basically banged the fuck out of my credit for $2. Cool. Cool, cool, cool.

Best part is they “forgave” the $2 and put my balance back to zero, but not before fucking my shit up.

File a correction notice with the three credit bureaus. Use the forgiveness as evidence and you’ll probably run into 3 scenarios

- Credit Bureaus wipe it after Chase doesn’t respond to their inquiry since it was $2

- Chase does respond to their inquiry and they agree that it should be wiped

- Chase does respond but they technically reported correct information at the time and credit bureau wont change it even though you got the money back

So 2/3 fall in your favor. Each bureau has a form for this on their website

Also their credit card processor most likely didn’t execute a small balance write off due to be great than .99 or due to the recent overdue payment. Each FI has rules for when a small balance just drops off but all kinds of caveats

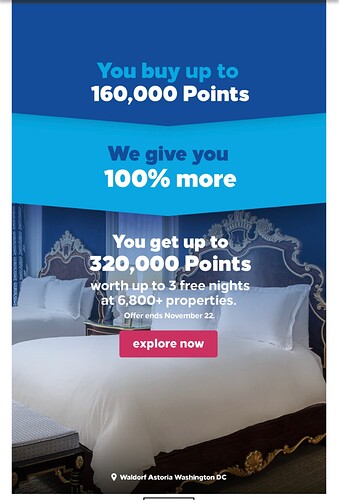

Credit card adjacent: anyone know how to value Hilton points? Trying to figure out if this is a good deal or nah.

Typical that means paging @jandywlu

EDIT: I am dumb

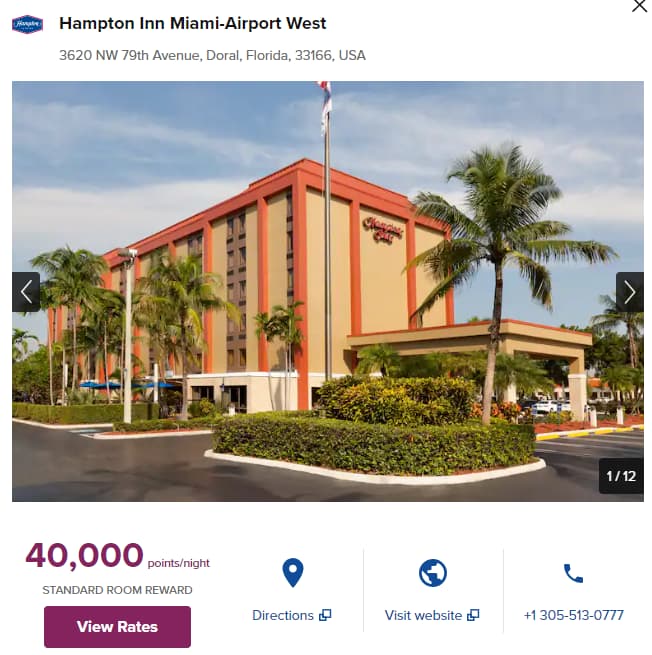

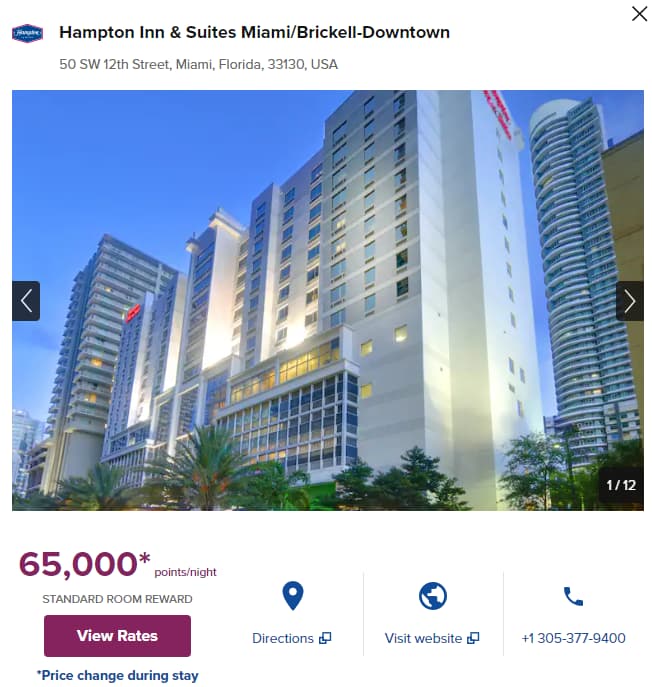

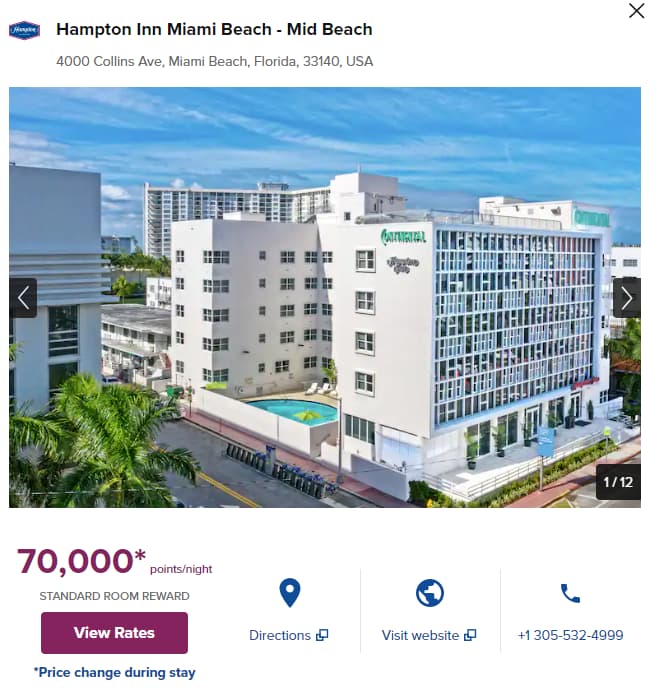

Depends how you’re gonna use them. Hilton points don’t go far at big resorts and whatnot, but can go very far at non-vacation destinations. For the sake of example, let’s look at points at three Hampton Inn’s in Miami for March 3-5, 2023.

For the one by the airport:

And for the one downtown:

And for the one on the beach:

The cash rate is $248, $409, and $550 respectively on these properties for the same dates.

Is this still valid?

Looking for a card that’s good for everyday (mainly groceries and restaurants). I have the AMEX Platinum and Chase Sapphire Preferred (looking to downgrade the Chase, only got it because my mortgage was with them and I knew nothing about credit cards at the time. AMEX customer experience has blown me away and made me a fanboy).

@jandywlu hit me with your advice lol

Edit: also planning a move shortly, planning a wedding, and booking honeymoon so can hit an intro bonus pretty pretty easily. RIP my bank account lol

Also, thank you to this thread in general. Hacked my way to two round trip AA flights from STL to Austin for $90 a piece points value. AMEX MR transferred to British Airways Avios. Genius stuff. Felt like a king. Also booked a Fine Hotels and Resorts Collection hotel for cheap with so many perks. Absolutely loving the AMEX Platinum (minus the terrible everyday spending categories, hence the need for help above)

Yep, looks like it’s still available! Here’s the link if you’re so inclined! I will forever be indebted to you for 30k points!

But honestly, the 90k sign on bonus is the best I’ve ever seen. Especially since it pays for itself in dining credits.

Apply for an American Express Card with this link. With your new Card, you could earn a welcome bonus and your friend could earn a referral bonus. Terms Apply. American Express

I was gonna say. The Amex Gold is one of the best I have seen for everyday spending.